By Constance GBEDZO

Corporate Governance and Enterprise Development

History has indicated that the ancient civilisations mined gold for its grandeur, diverse use and its convertibility into diverse forms.

Throughout history, gold has been used as a form of currency, and traded for goods and services. Egyptians were the first to use gold as a currency and medium of exchange.

The initial gold coin was produced under the reign of the Kushan Emperor Kanishka in India. Other countries such as Rome and Britain have historically utilized both gold and silver for monetary purposes and transactions at various points. Gold has consistently carried significant historical importance, serving not only as a form of money but also as an emblem of prosperity and a safeguard during times of financial instability.

Societies have long cherished this precious metal for its scarcity and lasting value. Gold continues to hold its worth. Financial experts have acknowledged its reliability and capacity to broaden investment portfolios, particularly when markets become unstable.

In 1792, the United States of America initiated the silver-gold standard monetary system, wherein the value of the dollar was linked to both gold and silver. Similarly, various global currencies anchored their values to the price of gold during this period.

Indeed, the balance of payments in international trade transactions were made through exchange of gold.

The silver-gold standard economic system fell apart, and gold and silver ceased serving as mediums of exchange with the introduction of the Bretton Woods Economic System.

During this period, when the U.S. dollar was fixed to the price of gold, every other country decided to link their own currencies to the value of the U.S. dollar instead. As such, the American currency took on the position of global currency.

The Bretton Woods system relied on specific guidelines, chief among them being adherence to monetary and fiscal policies aligned with the U.S. dollar.

Nonetheless, the Bretton Woods System disintegrated from 1971 to 1973 primarily because of expansionary monetary policies that were unsuitable for the leading currency nation. Consequently, this breakdown prompted most nations to adopt a regulated floating exchange rate regime.

In 1958, when Ghana introduced its national currency, the initial reserve assets consisted of gold, Sterling, and short-term funds in the UK, along with British Treasury Bills having maturity periods of up to three months, amongst other things.

During the fiscal year of 1960-61, the administrators of Ghana’s economic system opted to increase the quantity of gold within the reserve assets portfolio intended for the cedi.

This choice led to the acquisition of a modest quantity of purified gold, worth approximately US$3.7 million, which was bought overseas and moved into the bank’s vault. Nonetheless, during the 1960s when the price of gold decreased, there was a change in strategy away from using gold as a reserve asset towards favoring foreign currencies and securities.

Later on, the external reserves held by the Central Bank of Ghana have consistently increased throughout the past twenty years, reaching approximately US$11.00 billion by 2021.

Nevertheless, the amount of gold reserves has stayed constant at 8.77 tonnes, with the mean value of these gold reserves representing 6.14% of the total Gross International Reserves (GIR).

The extraction of gold in Ghana dates back over a century. Between the 15th and 18th centuries, due to the wealth of mineral assets discovered, the early merchants named the country “Gold Coast”. Due to the abundance of gold minerals, mining became prevalent, with riverbanks being searched for gold grains.

Nevertheless, statistics show that in 2019, when Ghana was adjudged the largest producer of gold in Africa and the 7th largest in the world, other central banks acquired a record level of 670 tonnes of gold to boost their reserve.

Interestingly, Ghana’s gold is still exported in its raw state. Notwithstanding, Gold exports in 2022 accounted for about 7.5% of Ghana’s GDP. The mining sector, with gold as the dominant mineral, provides about 40% of Ghana’s foreign exchange earnings.

Despite the growth of Ghana’s oil industry, gold mining remains the mainstay of the country’s fiscal stability and economic growth. In 2023, gold mining added GH₵8.6 billion (US$580 million) to Ghana’s GDP.

Nevertheless, Ghana did not increase its gold reserves during this period. According to data from the IMF and the World Gold Council, major industrialized nations possessed the highest volumes of gold reserves as of 2021.

Following this, the leading emerging markets are ahead, whereas major developing nations trail behind. On a global scale, over the last ten years, central banks’ demand for gold has ranked third after jewelry, technology, and investment sectors.

Throughout the COVID-19 pandemic era, central banks experienced only a slight decrease in their desire for gold. However, more central banks chose to buy gold than sell it during this time frame. Many of these buying institutions came from developing nations with smaller proportions of gold relative to their total foreign exchange reserves.

For example, Turkey was the biggest buyer of gold annually, increasing its official gold reserves by 134.5 metric tons just in 2020. During the same period marked by the pandemic, significant buyers included India, Russia, the United Arab Emirates, Qatar, Colombia, and Cambodia, amongst others.

It should be mentioned that as of 2021, Ghana had still not fully capitalized on the economic potential of its gold mining sector. This changed with the introduction of the Domestic Gold Purchase Programme (DGPP) by the Bank of Ghana (BOG), which was initiated on June 21, 2021, aimed at purchasing gold to bolster national reserves.

The aim was to increase the Central Bank’s gold holdings twofold in order to substantially alter how the Bank manages its foreign exchange reserves.

The DGPP aimed to act as a conduit for supporting reforms within the Artisanal and Small-Scale Gold Mining sector (ASGM) and to set up accountable supply chains for ASGM gold originating from Ghana.

The Bank believed that the extraction of this valuable mineral should be carried out responsibly to guarantee maximum advantages are obtained without causing excessive damage to the natural surroundings.

Next, in 2024, the government launched the Gold-for-Oil program (G4O), utilizing gold as payment for oil imports. This initiative helped stabilize fuel prices and alleviated strain on the country’s foreign exchange reserves.

The execution of the DGPP and its G4O element was marred by an unsuitable ‘tone from the top.’ Consequently, despite their good intentions, these programs lacked the necessary well-considered legal framework to support their goals effectively.

In the end, those goals were never realized. We were informed that the Bank of Ghana suffered losses as a consequence.

The Bank of Ghana additionally launched alternative gold-backed investment options known as ‘the Ghana Gold Coin’ through their domestic gold initiative in 2021.

This particular offering, along with other gold-based investment options such as stocks and mutual funds, was not heavily marketed by the bank as alternatives capable of delivering superior returns compared to conventional choices like savings accounts and government securities.

After observing the chaotic rollout of the DGPP and its G4O element, the NDC administration headed by President John Mahama promptly moved forward with setting up the Ghana Gold Board as outlined in their party’s platform.

Within 90 days of taking office, the Ghana Gold Board Act (Act 1140) was signed into law in April 2025. The regulatory body established through this act has the responsibility to perform the following tasks:

- Managing the acquisition, evaluation, sale, and export of gold and various minerals.

- Standardize gold trading practices among small-scale miners

- Support responsible mining

- Foster value enhancement for gold and other mineral resources.

- Improve tracking capabilities and support Ghana’s initiatives to obtain LBMA accreditation

- Create currency exchanges and similar topics

- Facilitate the buildup of the gold reserves by the Bank of Ghana.

The Ghana Gold Board seems to be a groundbreaking move and a strategic maneuver capable of turning Ghana’s gold from just another commodity or means of exchange into an economic tool for the Ministry of Finance and the Central Bank of Ghana. This transformation would enable them to effectively manage both fiscal and monetary policies.

When executed effectively, this solution can boost profits and reduce smuggling, encourage greater gold acquisitions from artisanal miners, and minimize unlawful practices. It also aims to simplify the entire gold supply process—from mining to selling—ensuring responsible procurement and optimizing income generation.

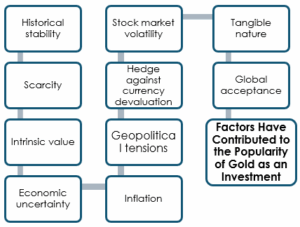

Throughout history, the development of gold as an investment tool has been impressive. There is significant anticipation regarding gold’s potential performance as an investment in the future.

The prospects for gold as an investment seem promising, driven by increasing demand from developing economies and global political instabilities. Its intrinsic worth and scarcity make it a reliable hedge against inflation and depreciation of the cedi.

Ghana has the opportunity to leverage various financial tools associated with gold to achieve economic stability.

Certainly, the Securities and Exchange Commission, alongside the Central Bank of Ghana and various private-sector financial institutions, should utilize the chances presented by the GoldBOD to create financial products tailored for both individual members of the private sector and institutional investors.

This is expected to lead to a decrease in the overly high demand for the US Dollar as a medium for storing value.

Certainly, incorporating Gold Exchange-Traded Funds (Gold ETFs), gold-oriented mutual funds, Sovereign Gold Bonds, or tangible gold into established investment portfolios can aid in reducing risks and providing stability over the long term.

In order to capitalize on this opportunity, investors ought to think about broadening their investment portfolio and keeping abreast of worldwide economic developments.

This requires support through selfless cooperation among major players in the financial sector and strong promotion of these offerings as an alternative to traditional investment options.

About the Author

With a diverse professional background spanning various sectors in Ghana, including roles in the audit service, Ernst and Young Ghana, international NGOs, audit/compliance and enterprise risk management in banking, academia, and consultancy, I have acquired extensive experience in finance, corporate governance, business strategy, and enterprise-all risk.

My journey through these organizations has provided me with insights into the challenges and shortcomings prevalent in Ghana’s socio-economic development.

Over the past few years, some reforms have been promulgated in the mining sector to ensure Ghana attains macro-economic stability. However, the Ghana Gold Board appears to be the masterstroke and the game changer.

Provided by SyndiGate Media Inc. (

Syndigate.info

).